First and foremost, small business owners should assess their invoicing needs and identify the features that are essential for their operations. Common features to look for in billing software include customizable invoice templates, automated invoicing schedules, recurring billing options, online payment processing, and integration with accounting software. By prioritizing features based on their specific requirements, businesses can narrow down their options and focus on solutions that align with their goals and objectives.

Another important consideration when choosing billing software is pricing and affordability. While some billing software solutions offer subscription-based pricing models with monthly or annual fees, others may charge per transaction or offer free plans with limited features. Small business owners should evaluate the pricing structure of each solution and consider factors such as scalability, additional fees, and return on investment. It's essential to strike a balance between cost and value to ensure that the chosen billing software meets the business's needs without breaking the budget.

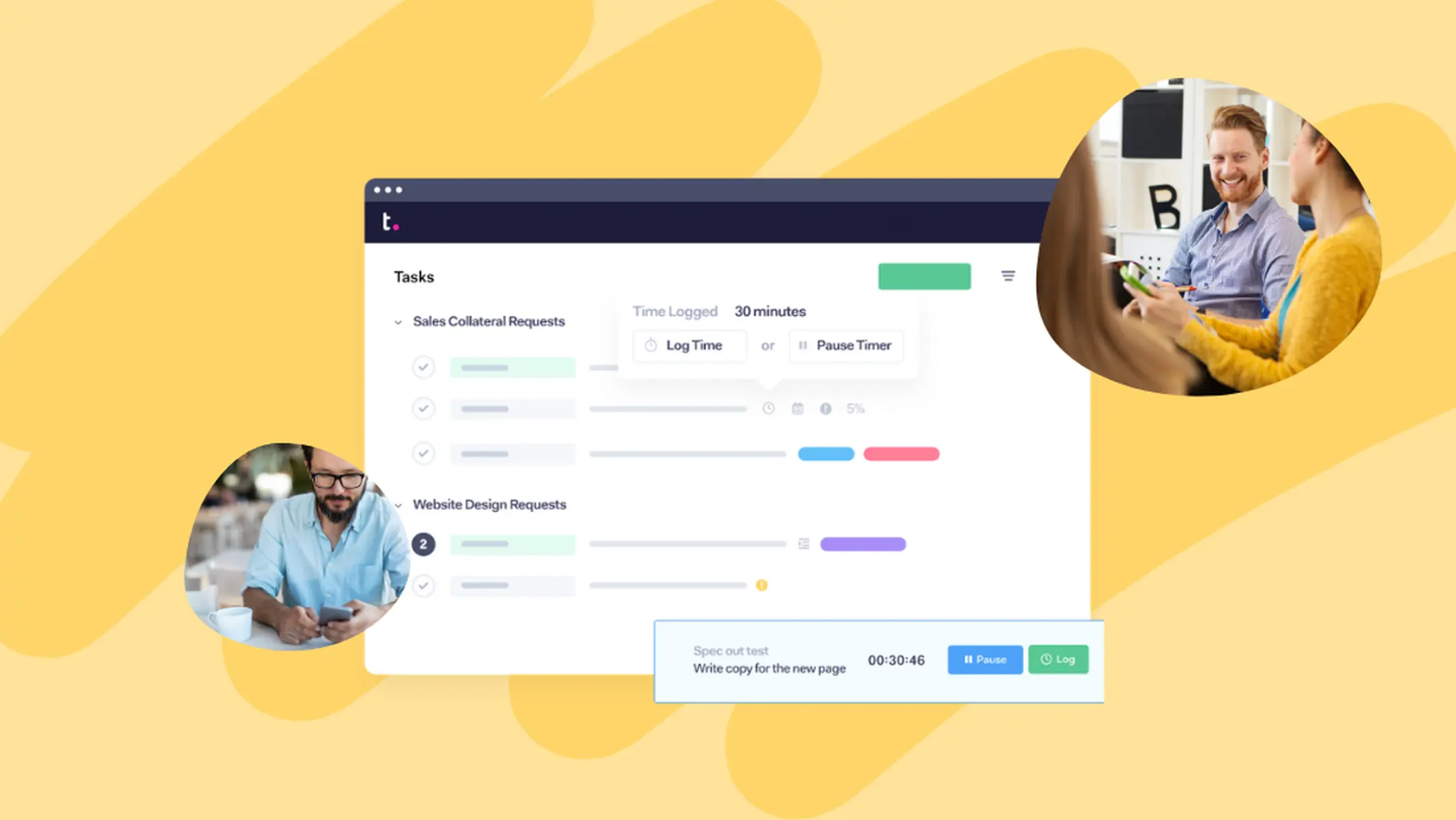

Usability and ease of use are also critical factors to consider when evaluating billing software options. The software should be intuitive, user-friendly, and require minimal training to onboard staff and get up and running quickly. Small business owners should look for software that offers a clean and intuitive interface, straightforward navigation, and helpful support resources such as tutorials, documentation, and customer support.

Integration capabilities are another key consideration when selecting billing software for small businesses. Ideally, the chosen solution should seamlessly integrate with existing systems and software used by the business, such as accounting software, CRM platforms, or e-commerce platforms. Integration eliminates the need for manual data entry and ensures consistency and accuracy across systems, saving time and reducing errors.

Additionally, small business owners should consider factors such as customer support, security features, and scalability when evaluating billing software options. Reliable customer support is essential for resolving issues promptly and ensuring smooth operations, especially during critical periods such as billing cycles or system upgrades. Security features such as data encryption, secure payment processing, and compliance with industry standards ensure the protection of sensitive financial information and safeguard against fraud or cyber threats. Scalability is also important to accommodate future growth and expansion without outgrowing the chosen billing software solution.

In conclusion, choosing the right billing software is a crucial decision for small business owners seeking to streamline their invoicing processes, improve cash flow, and enhance financial management. By assessing their invoicing needs, evaluating features and pricing, considering usability and integration capabilities, and prioritizing factors such as customer support, security, and scalability, businesses can select a billing software solution that meets their requirements and supports their growth and success.